Why Is It So Hard to Pay Off Your Credit Card? (Part 3)

Part 3: Lifestyle Creep — The Slow Drift That Becomes the Avalanche

You had a few splurges.

Then came the crisis—car repairs, a medical bill, a stretch of unemployment.

You figured you’d bounce back.

But now, the bounce isn’t happening.

And without fully realizing it, your lifestyle—the routines, the spending patterns, the monthly “norms”—has quietly expanded.

At the same time, the world around you has shifted.

And holding steady now costs more than it used to.

The Drift Begins Quietly

It doesn’t start with excess.

It starts with survival—and self-soothing.

- A nice dinner after a long week

- New clothes for a job interview

- A small vacation to reset after burnout

Then a crisis hits.

You lean on the card. You plan to make up for it.

But then groceries go up.

Your rent renews at a higher rate.

The minimum payment on your card grows quietly, and so does the interest.

You’re not making bad decisions.

You’re just trying to hold onto a life that felt sustainable before the drift.

When the Economy Adds Weight

You’re not imagining it—your money doesn’t go as far as it used to.

- Inflation has raised the cost of nearly everything: groceries, gas, utilities, healthcare.

- Interest rates mean you’re paying more just to carry the same debt.

- Wages haven’t risen at the same pace.

So now, it’s not just lifestyle creep.

It’s economic compression.

What once felt reasonable is now barely manageable.

And what once felt like a cushion is now a crack in the floor.

You haven’t added luxury. You’ve added normalcy.

But even maintaining that has started to cost more than you can comfortably afford.

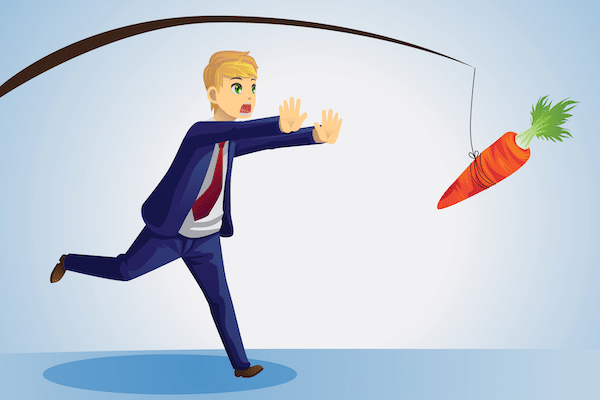

A Swim Against the Tide

The splurges were the start.

The emergency cracked your footing.

And now, macro-economic pressure is flooding in from every direction.

The water‚Äôs rising‚Äîand you’re swimming with weights on.

This is the tipping point most people don’t talk about:

When your economic productivity becomes a net negative—

when your income no longer covers the cost of living as it exists today.

You’re not failing.

You’re fighting gravity.

Credit cards become the bridge—but that bridge is crumbling under the weight.

This is how the avalanche forms.

Not all at once—but in layers.

Each layer makes the next feel inevitable.

Each step makes the climb out harder to see.

Final Thought

Debt rarely arrives like a lightning bolt.

It builds slowly—through a thousand decisions, emotional pivots, and external forces you didn’t create and can’t control.

And by the time you look up, you’re not just in debt.

You’re in motion, sliding, sinking—working hard and still falling behind.

At Dealing With Debt, we believe naming this process is the first step toward changing it.

Not with blame. But with truth. With clarity. With community.

You are not broken.

You are swimming upstream in a current far stronger than most people realize.

We’ll face it together.

Because understanding how it happens is the start of taking back control—one budget at a time.

Responses