Why Don’t We Talk About Money?

Talking Will Lead To A Healthier Relationship With Your Money

We’ve come a long way as a society when it comes to discussing the once-undiscussable.

There was a time when speaking openly about race was considered inappropriate. Talking about sex? Off-limits. Identity, orientation, mental health—each of these topics, once shrouded in stigma, have gradually made their way into the light through honest, collective conversation.

But there’s one subject that continues to live in the shadows, despite touching nearly every single one of us: money.

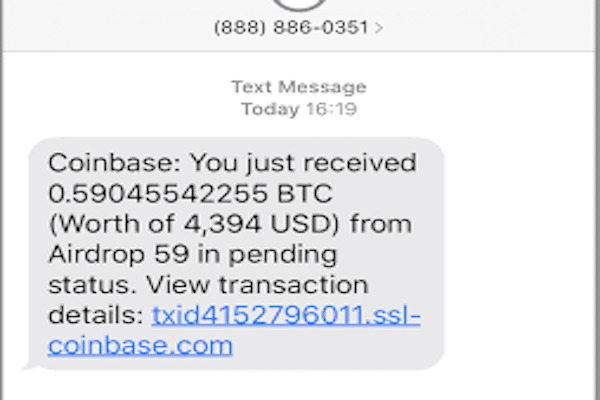

Not money in the abstract sense—stocks, crypto, or “how to make six figures from your phone.” We’re talking about real-life financial realities:

- What we’re earning (or not).

- What we’re spending.

- The weight of our debt.

- The fear of not having enough.

Even among friends, families, and partners, these conversations are often steeped in discomfort—or avoided altogether. And yet, the consequences of this silence are everywhere.

The Quiet Pressure of Financial Silence

Money is one of the leading causes of stress in America. More than half of Americans live paycheck to paycheck, and nearly three-quarters report feeling overwhelmed by their finances. But you’d never know it from the way we talk—because we often don’t.

This silence isn’t just awkward—it’s harmful. It isolates people. It reinforces shame. And it allows misunderstandings and misinformation to thrive.

In a culture that often equates financial status with personal worth, the fear of being judged—or seen as “irresponsible”—can keep people stuck in silence. But here’s the thing: your financial situation is not a moral failing. And financial vulnerability shouldn’t be a source of shame.

Breaking the Silence, One Conversation at a Time

At Dealing With Debt, we believe that financial well-being starts with honest conversations.

That’s why we’ve created a judgment-free, anonymous space where people can take off the mask, be real about their financial worries, and ask the questions they’ve been too afraid to voice. Whether you’re buried in debt, navigating job loss, or simply trying to make sense of your financial goals, you’re not alone—and you’re not broken.

We offer:

- Expert guidance that meets people where they are, not where they “should” be.

- Practical tools to help individuals understand their finances and make informed decisions.

- Supportive community spaces where vulnerability is met with empathy, not judgment.

Because when we talk about money honestly, we open the door to learning, growth, and stability.

A New Kind of Financial Wellness

Talking about money doesn’t have to be taboo. It can be grounding. Liberating.

By normalizing conversations around debt, budgeting, and setting goals, we can dismantle outdated norms and create a culture where transparency is strength—not weakness.

At Dealing With Debt, we’re not teaching people how to manage money. We’re helping them feel seen, supported, and to gain confidence in their ability to take control of their future. One open conversation at a time.

✅ Final Thought

It’s time to take money off the list of forbidden topics. Because if we want to reduce stress, build confidence, and create lasting stability—we must start talking.

Dealing With Debt is here to provide the space and, when necessary, lead these conversations with compassion, clarity, and community. Together, we can break the silence around money, erase the fear and shame, and create a future rooted in financial wellness—one budget at a time.

Responses