Gambling Apps Are Coming for Your Pizza Money.

A Parent’s Wake-Up Call About College Kids & Gambling Apps

I used to think the biggest late-night surprise from my college-aged kids would be a Venmo request for pizza or a textbook they forgot to budget for.

But lately, I’ve started hearing different kinds of stories. Stories that don’t end in a laugh or a shared eye-roll. Stories that sit heavy in my chest. Stories that have made me look twice at my own children—and the world they’re living in.

When the Loan Meant for School Fueled a Spiral

I recently read a story about Ellie (linked below: warning paywalled). She shares how her son, a sophomore, had been using his student loan money to bet on sports through a gambling app. What started as a fun way to feel more connected to his favorite teams quickly turned into something darker. His grades slipped. His sleep disappeared. And before she knew what was happening, he was nearly $10,000 in debt.

The money meant for tuition, for books, for a future—gone in the name of a “sure thing.”

Ellie didn’t know. Not until the collectors started calling. The title of the story “I Got Divorced Because of Sports Gambling” kind of gives it away. Source

Anna’s Brother: Behind the Screen Was a Struggle for Control

Then came Anna’s story. Her younger brother, a recent grad, developed a full-blown gambling addiction—quietly, from the solitude of his dorm room. The app was always there, always “on.” Bets could be placed in seconds. There was no casino, no cards, no one watching.

But the stakes? They were higher than ever.

His losses didn’t just cost him money. They cost him friendships, peace of mind, and nearly his degree. Source

Danielle’s Marriage: A Hidden Wager That Broke the Foundation

And then I read Danielle’s account. Not about a student this time—but about a partner. Her marriage ended after her husband fell deep into debt through online sports betting. She thought they were building a life together. Instead, she found out he had been secretly draining their accounts.

The betrayal, she said, wasn’t just financial. It was emotional. The apps, the dopamine, the allure of a comeback win—it had all taken his attention, his trust, and eventually, their future. Source

What I’ve Learned

After hearing these stories, I started doing some research. Here’s what’s kept me up at night:

- Nearly 60% of individuals aged 18 to 22 have participated in sports betting. And 4% of them are betting daily. (TIME)

- One in ten college students is now considered a pathological gambler—a rate significantly higher than the general population. (TIME)

- An estimated 12% of college students are using financial aid to gamble. (Intelligent.com)

This isn’t just a moral concern. It’s a financial and mental health crisis quietly taking shape in our dorm rooms, bedrooms, and back pockets.

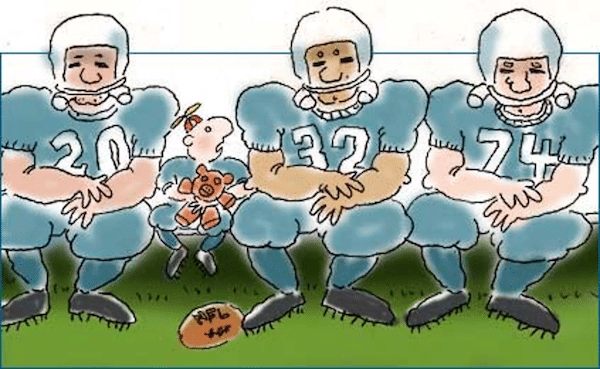

The Invisible Casino in Their Hands

What’s terrifying is how invisible it all is.

There’s no slurred speech, no dice being thrown, no poker faces. Just a quiet tap of a phone. An app designed with dopamine hits in mind. A scoreboard that updates in real time – instant gratification (or not). And a generation that already battles anxiety, perfectionism, and pressure from all sides.

And let’s not ignore this: the sports industry benefits. More bets mean more eyeballs. More engagement. More advertising revenue due to increased viewership. But who is watching? The scales between fan and gambler are tilting, and young adults are the perfect audience: impulsive, competitive, and newly independent. (AP News)

A Parent’s Plea

I have three young adult kids. Three smart, curious, fun, flawed humans. I love them more than anything. And I know they are growing up in a world I didn’t. A world where they can lose hundreds of dollars from their dorm bed before breakfast—and no one will know until it’s too late.

This isn’t an expert essay. It’s a parent’s voice in the noise. A hand reaching out to other parents who might not realize how close this is to their own home.

Please, talk to your kids. Ask them what they’re seeing. What apps they use. What their friends are doing. Not with judgment—but with curiosity and care.

Because the bets our kids are making aren’t always about money. Sometimes, they’re betting on their future. And by extension, yours.

Final Thought

At Dealing With Debt, we know financial strain rarely starts with a spreadsheet. It starts in the quiet, unseen moments—where stress meets opportunity and impulse fills the gap. That’s why we speak to real-life tension with real-life tools. Because reducing stress, building confidence, and protecting the next generation isn’t just our mission. It’s our responsibility.

Let’s protect our kids—before the cost gets too high.

Join the Dealing With Debt Community today for more great content

I’ve heard horror stories as well. It’s shame corporate greed is willing to victimize young people like this!