From Patience to Plastic: America Became a Nation of Consumers

There was a time when people dreamed big, saved slow, and bought only when they had the cash in hand. Our grandparents told stories of scrimping for years to buy a car. Of walking past store windows and saying, “One day, when we’ve saved enough.” That mindset wasn’t about deprivation—it was about pride. It was about ownership that was earned, not borrowed.

But something shifted. And now? We live in a country where the question isn’t, “Can I afford this?” but, “Can I qualify for this credit line?”

We used to wait. Now, we click.

A Culture of “Now”.

The decline of layaway is a metaphor for the transformation of America’s spending psyche. Once, layaway programs allowed shoppers to secure items while paying them off gradually—with no interest and no shame. It was a structure built on delayed gratification. You earned the purchase over time.

Today, layaway has been replaced with high-interest credit, Buy Now Pay Later apps, and a financial system that says, “Why wait?” But that convenience comes at a cost—often 20%, 30%, or more in interest and fees.

As Addison Wiggin said, “It’s a debt-based economy designed to keep people spending money they don’t have, to buy things they don’t need, to impress people that don’t matter.”

The Emotional Economics of Wanting More.

We don’t just spend to survive. We spend to feel seen, to soothe stress, to prove our worth.

Impulse spending isn’t just a lack of discipline. It’s a response to modern pressures: social media, lifestyle marketing, and financial insecurity. When everything in our feed is a highlight reel, it’s easy to feel like buying something will bring us closer to that ideal life. And when credit is one swipe away, the dopamine rush is instant.

But then comes the regret. The minimum payments. The cycle.

Credit: The New Normal.

In 1950, fewer than 1 in 10 American households carried revolving debt. Today, 77% of U.S. adults have at least one credit card. And for many, it’s not just a tool—it’s a crutch. The promise of instant access has replaced the practice of long-term planning.

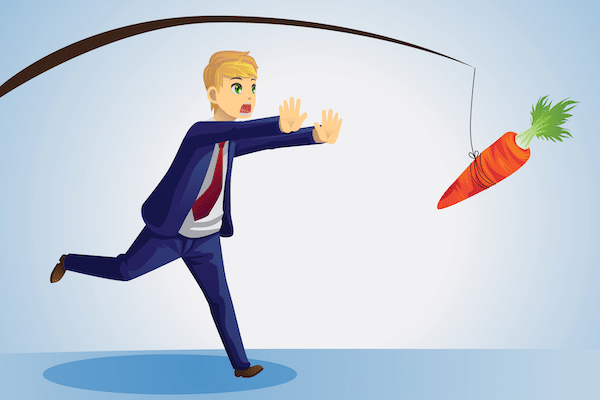

Worse still, many don’t realize how that “available balance” becomes emotional bait. In reality, it’s borrowed money, sold under the illusion of freedom.

When every impulse becomes a payment plan, and every indulgence a long-term cost, we’re no longer buying things—we’re buying debt.

So, What Changed?

The shift from savers to consumers didn’t happen overnight. It was cultivated. By banks. By marketers. By the illusion that convenience is king. And today’s tools—like Buy Now, Pay Later apps—blur the lines even further.

We’ve traded the slow burn of saving for the fast flame of gratification. But those fast flames? They burn through paychecks, peace of mind, and future goals.

A New Way Forward.

It’s time to reframe what “waiting” means. Waiting can mean strength. Planning can mean pride. And choosing not to buy today doesn’t make you poor—it makes you powerful.

Because the reality is: financial freedom isn’t about how much you spend. It’s about how much control you keep. How much ownership and equity you have.

Final Thought.

The fire of impulse is hot—but it burns fast. When we rebuild a culture that honors patience, discipline, and thoughtful spending, we take the power back. Not just from the credit card companies, but from the myth that we are what we buy.

At Dealing With Debt, we believe you deserve more than short-term thrills and long-term bills. Our mission is to reduce financial stress, build confidence, and create a more stable future—one budget at a time.

Let’s keep rewriting the story.

Responses