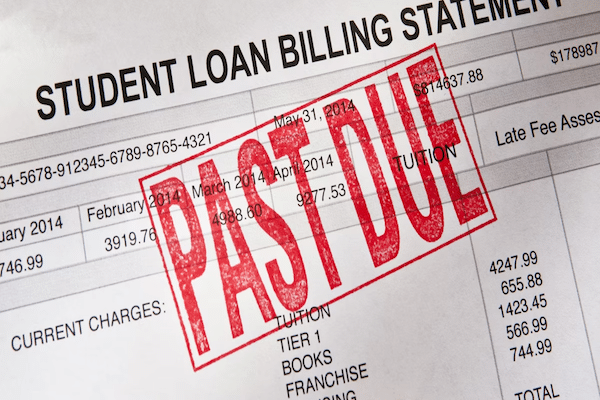

Finding Your Way Through the Student Loan Maze

On our recent Level Up podcast, we sat down with Sean Lenderink, founder of Smart Loan Aid, to dig into a side of the student loan crisis that isn’t just about numbers—it’s about confusion. For many borrowers, the most overwhelming part of repaying student loans isn’t the debt itself, it’s figuring out how to manage it.

Sean explained why so many borrowers feel lost. Federal student loans aren’t straightforward. They get passed from one servicer to another, repayment plans have complicated names and rules, and programs that could actually help—like income-driven repayment or forgiveness—are often hidden behind walls of red tape. It’s no wonder people don’t know where to start.

Why It Feels So Confusing

- Constant changes in servicers: Borrowers often don’t even know who to send payments to from one year to the next.

- Too many repayment plans: Income-driven repayment, standard repayment, graduated repayment—the list is long and the terms can be misleading.

- Forgiveness promises: Talk of forgiveness programs has left many borrowers waiting, unsure if they should pay or hold off.

As Sean told us, the result is paralysis. Borrowers don’t make decisions, payments stall, and defaults rise—not always because people don’t want or not able to pay, but because they don’t know how or who to pay.

What It Takes to Get Back on Track

Sean and his team at Smart Loan Aid specialize in helping borrowers cut through the noise. Here’s what that looks like:

- Assistance locating the loans and identifying the current servicer

- Clear explanations of repayment options so borrowers actually understand their choices.

- Guidance on income-driven repayment (IDR) plans, which can dramatically lower monthly payments based on what you earn.

- Support during default and garnishment, including setting up rehabilitation programs with the lowest possible “good faith” payments.

The goal, Sean said, is to help people regain a sense of control. When you know your options and have a roadmap, the stress eases—and the risk of default goes down.

A Human Problem, Not Just a Math Problem

Student loans are often talked about in terms of trillions of dollars and millions of borrowers. But for Sean, every borrower is an individual with their own story, their own fears, and their own goals. Navigating repayment is as much about emotional relief as it is about financial structure.

As he put it, Smart Loan Aid exists to give people clarity: “Borrowers shouldn’t have to feel like they’re fighting this battle alone.”

Final Thought

The student loan system may be complicated, but getting back on track doesn’t have to be. With the right guidance, borrowers can step out of confusion, avoid default, and start building a stable financial future.

üéß For the full conversation with Sean Lenderink of Smart Loan Aid‚Äîincluding why the system feels so overwhelming, and how to take practical steps toward stability‚Äîcatch the full episode on one of our channels below

Responses