The Debt System Is a Hammer—Here’s How to Build, Not Break

Debt gets a bad rap—and let’s be honest, it deserves it.

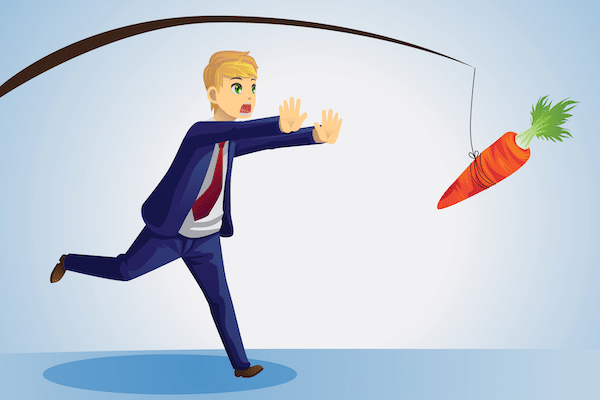

Credit cards, payday loans, 72-month car notes… They lure you in, then gut you like a fish.

But here’s the twist nobody tells you when you’re scraping by on overdraft protection:

Debt is just a tool. And like any tool, it can either build something—or wreck everything.

A hammer can smash a window. Or it can build a house.

Same hammer. Different hands.

So how do you go from getting crushed by debt… to using it like a pro?

Let’s break it down.

Part 1: What They Don’t Teach You About Money

Most of us grew up with two choices:

- Be responsible and avoid debt altogether (hard when life keeps getting more expensive), or

- Use credit just to keep the lights on—and hope for a raise, a tax refund, or divine intervention.

Meanwhile, people with yachts, real estate portfolios, and corporate tax shelters are borrowing money all the time—and getting rich doing it.

The difference? They borrow to buy assets.

- Assets produce income.

- Liabilities cost you income.

You finance a car? It loses value every mile.

You finance a rental property? It brings in rent.

See the difference?

This isn’t about some “get rich” trick. This is about understanding the machine you’re inside… so you can stop getting ground up by it.

Part 2: First, Get Off the Battlefield

Before you can wield the system like a weapon, you’ve gotta stop bleeding.

If you’re in a debt-settlement program right now, that’s your training ground.

- You’re learning how to live on less than you make.

- You’re seeing how interest works against you.

- You’re feeling the weight of compounding… from the wrong side.

That’s a hard education. But it’s also a powerful one. Because once you’re through it, you’ll never fall for the same trap again.

Let the banks keep their glossy brochures and 0%-for-12-month bait. You’ve seen the fine print now.

Part 3: When Debt Becomes a Tool

Here’s what no one ever told you during your “exit interview” from high school:

Wealthy people don’t avoid debt. They strategize with it.

Let‚Äôs say one day, you’re stable. Bills are paid. You‚Äôve got a few grand in savings. You‚Äôve rebuilt your credit score‚Äînot to buy a TV, but because you‚Äôve learned how the system rates your trustworthiness.

That’s when debt becomes a tool.

- You can borrow to invest in a business that earns real income.

- You can finance property that appreciates over time while producing rent.

- You can use 0% intro offers (if and only if you’ve learned how to manage them) to consolidate or free up cash flow.

But here’s the golden rule:

Never borrow for something that won’t make you money, save you money, or build long-term value.

A weekend getaway on a credit card is not wealth-building.

An investment in a skill, license, or tool that increases your income? That’s different.

Part 4: The Long Game

Debt is part of the system. Always has been, always will be.

But once you stop thinking like a consumer—and start thinking like a capital allocator—everything changes.

You don’t need to be rich to start acting like it.

You need clarity. Strategy. And the kind of stubborn patience that knows overnight success takes about 10 years.

Right now, you’re in the hard part. The cleanup. The crawl back.

But stick with it long enough, and you’ll see:

Debt isn’t the enemy. Misused debt is.

And you?

You’re learning to be the kind of person who doesn‚Äôt fall for easy money anymore.

You’re learning to build.

Coming Next:

“What Is Real Wealth, Anyway?”

Hint: It’s not just money in the bank. It’s control, security, and choices. And it starts with a mindset shift.

Responses